-

INFLATION FALLS AGAIN AS BOND MARKETS RECONSIDER THE LIKELY PATH OF INTEREST RATES

Data Sourced from FE Analytics, and Bloomberg Finance LP

INFLATION FALLS AGAIN AS BOND MARKETS RECONSIDER THE LIKELY PATH OF INTEREST RATES

This week brought another twist in the gradually evolving story of inflation. In the US – which up to now has seen the most rapid decline – inflation fell only slightly as both CPI and core failed to match expectations. In contrast, the UK has seen inflation decline only modestly in recent months, but January brought a much faster reduction than expected. As usual, this generated a lot of speculation that the Federal Reserve and Bank of England will deviate from the trajectories that markets have mapped out for their interest rates.

What has been interesting this week is the release of supporting information. The US is a consumer driven economy and resilient inflation has been accompanied by very strong retail spending in January. In the UK, inflation may have fallen for the third month but CPI remains above 10%, and jobs data points to a tight labour market with wages rising steadily. Inflation does appear to be past its peak but the path to getting inflation back to target is unlikely to run smoothly and we are likely to see further volatility as markets are forced to readjust.

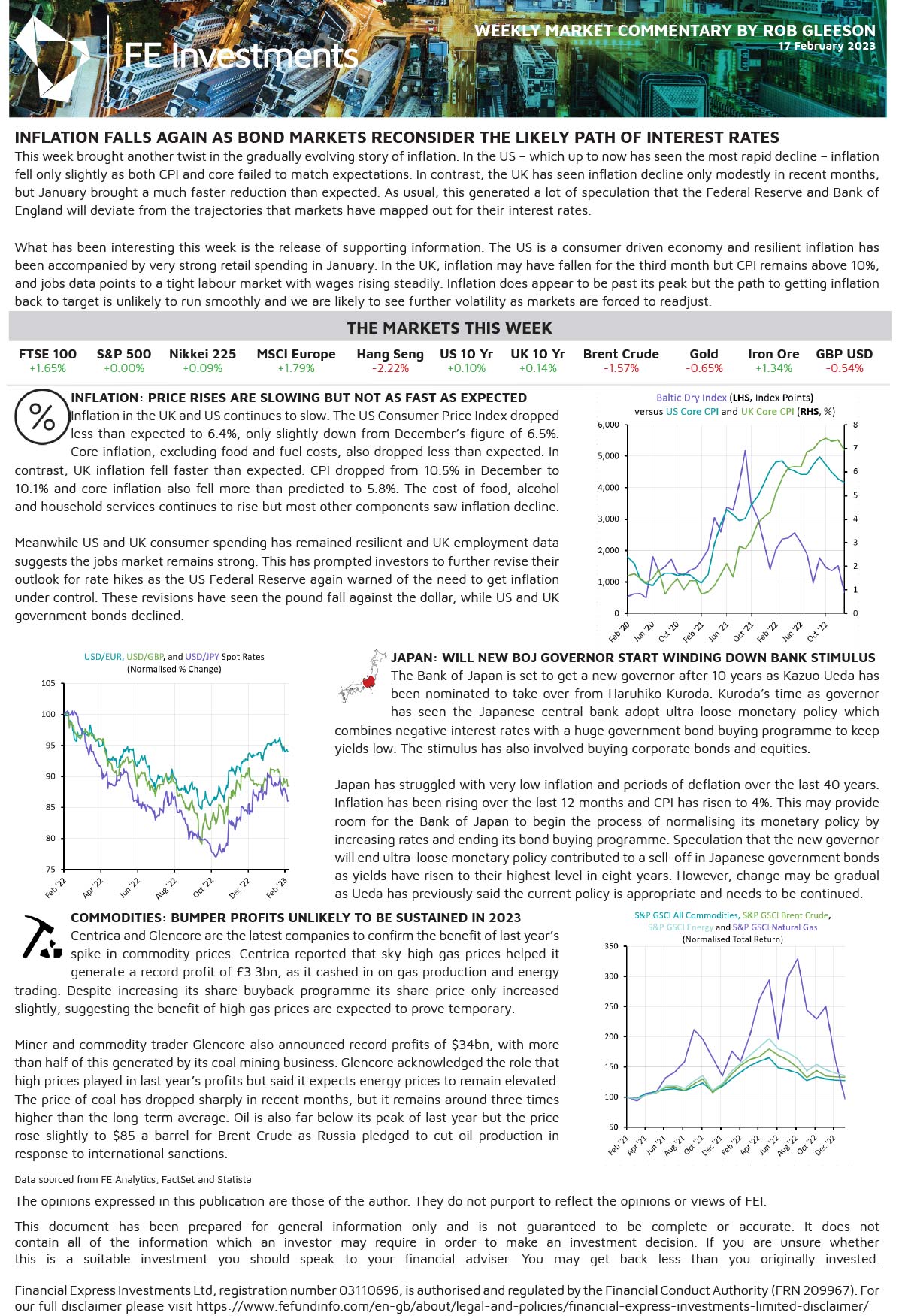

INFLATION: PRICE RISES ARE SLOWING BUT NOT AS FAST AS EXPECTED

Inflation in the UK and US continues to slow. The US Consumer Price Index dropped less than expected to 6.4%, only slightly down from December’s figure of 6.5%. Core inflation, excluding food and fuel costs, also dropped less than expected. In contrast, UK inflation fell faster than expected. CPI dropped from 10.5% in December to 10.1% and core inflation also fell more than predicted to 5.8%. The cost of food, alcohol and household services continues to rise but most other components saw inflation decline.

Meanwhile US and UK consumer spending has remained resilient and UK employment data suggests the jobs market remains strong. This has prompted investors to further revise their outlook for rate hikes as the US Federal Reserve again warned of the need to get inflation under control. These revisions have seen the pound fall against the dollar, while US and UK government bonds declined.

JAPAN: WILL NEW BOJ GOVERNOR START WINDING DOWN BANK STIMULUS

The Bank of Japan is set to get a new governor after 10 years as Kazuo Ueda has been nominated to take over from Haruhiko Kuroda. Kuroda’s time as governor has seen the Japanese central bank adopt ultra-loose monetary policy which combines negative interest rates with a huge government bond buying programme to keep yields low. The stimulus has also involved buying corporate bonds and equities.

Japan has struggled with very low inflation and periods of deflation over the last 40 years. Inflation has been rising over the last 12 months and CPI has risen to 4%. This may provide room for the Bank of Japan to begin the process of normalising its monetary policy by increasing rates and ending its bond buying programme. Speculation that the new governor will end ultra-loose monetary policy contributed to a sell-off in Japanese government bonds as yields have risen to their highest level in eight years. However, change may be gradual as Ueda has previously said the current policy is appropriate and needs to be continued.

COMMODITIES: BUMPER PROFITS UNLIKELY TO BE SUSTAINED IN 2023

Centrica and Glencore are the latest companies to confirm the benefit of last year’s spike in commodity prices. Centrica reported that sky-high gas prices helped it generate a record profit of £3.3bn, as it cashed in on gas production and energy trading. Despite increasing its share buyback programme its share price only increased slightly, suggesting the benefit of high gas prices are expected to prove temporary.

Miner and commodity trader Glencore also announced record profits of $34bn, with more than half of this generated by its coal mining business. Glencore acknowledged the role that high prices played in last year’s profits but said it expects energy prices to remain elevated. The price of coal has dropped sharply in recent months, but it remains around three times higher than the long-term average. Oil is also far below its peak of last year but the price rose slightly to $85 a barrel for Brent Crude as Russia pledged to cut oil production in response to international sanctions.

For more information regarding our weekly market reports, we encourage you to give us a call on 01732 746188 or send us an email at enquiries@foxgroveassociates.co.uk.

This document has been prepared for general information only. It does not contain all of the information which an investor may require in order to make an investment decision. If you are unsure whether this is a suitable investment you should speak to your financial adviser. This information is not guaranteed to be correct, complete, or accurate. Financial Express Investments Ltd, registration number 03110696, is authorised and regulated by the Financial Conduct Authority (FRN 209967). For our full disclaimer please visit https://www.fefundinfo.com/en-gb/about/legal-and-policies/.