-

FEDERAL RESERVE CUTS RATES AND OPENS THE WAY FOR FURTHER REDUCTIONS

Data Sourced from FE Analytics, and Bloomberg Finance LP

FEDERAL RESERVE CUTS RATES AND OPENS THE WAY FOR FURTHER REDUCTIONS

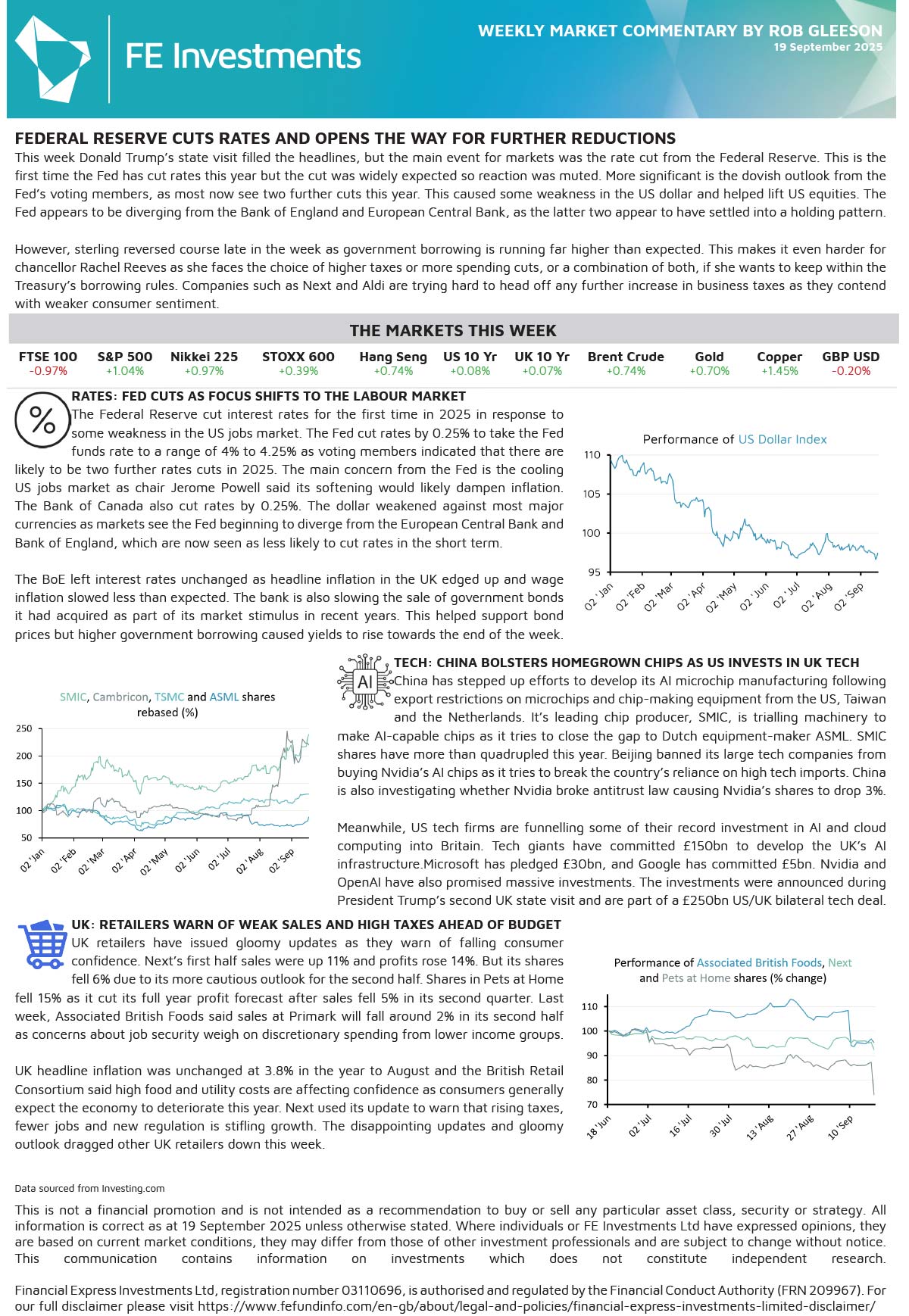

This week Donald Trump’s state visit filled the headlines, but the main event for markets was the rate cut from the Federal Reserve. This is the first time the Fed has cut rates this year but the cut was widely expected so reaction was muted. More significant is the dovish outlook from the Fed’s voting members, as most now see two further cuts this year. This caused some weakness in the US dollar and helped lift US equities. The Fed appears to be diverging from the Bank of England and European Central Bank, as the latter two appear to have settled into a holding pattern.

However, sterling reversed course late in the week as government borrowing is running far higher than expected. This makes it even harder for chancellor Rachel Reeves as she faces the choice of higher taxes or more spending cuts, or a combination of both, if she wants to keep within the Treasury’s borrowing rules. Companies such as Next and Aldi are trying hard to head off any further increase in business taxes as they contend with weaker consumer sentiment.

RATES: FED CUTS AS FOCUS SHIFTS TO THE LABOUR MARKET

The Federal Reserve cut interest rates for the first time in 2025 in response to some weakness in the US jobs market. The Fed cut rates by 0.25% to take the Fed funds rate to a range of 4% to 4.25% as voting members indicated that there are likely to be two further rates cuts in 2025. The main concern from the Fed is the cooling US jobs market as chair Jerome Powell said its softening would likely dampen inflation. The Bank of Canada also cut rates by 0.25%. The dollar weakened against most major currencies as markets see the Fed beginning to diverge from the European Central Bank and Bank of England, which are now seen as less likely to cut rates in the short term.

The BoE left interest rates unchanged as headline inflation in the UK edged up and wage inflation slowed less than expected. The bank is also slowing the sale of government bonds it had acquired as part of its market stimulus in recent years. This helped support bond prices but higher government borrowing caused yields to rise towards the end of the week.

TECH: CHINA BOLSTERS HOMEGROWN CHIPS AS US INVESTS IN UK TECH

China has stepped up efforts to develop its AI microchip manufacturing following export restrictions on microchips and chip-making equipment from the US, Taiwan and the Netherlands. It’s leading chip producer, SMIC, is trialling machinery to make AI-capable chips as it tries to close the gap to Dutch equipment-maker ASML. SMIC shares have more than quadrupled this year. Beijing banned its large tech companies from buying Nvidia’s AI chips as it tries to break the country’s reliance on high tech imports. China is also investigating whether Nvidia broke antitrust law causing Nvidia’s shares to drop 3%.

Meanwhile, US tech firms are funnelling some of their record investment in AI and cloud computing into Britain. Tech giants have committed £150bn to develop the UK’s AI infrastructure.Microsoft has pledged £30bn, and Google has committed £5bn. Nvidia and OpenAI have also promised massive investments. The investments were announced during President Trump’s second UK state visit and are part of a £250bn US/UK bilateral tech deal.

UK: RETAILERS WARN OF WEAK SALES AND HIGH TAXES AHEAD OF BUDGET

UK retailers have issued gloomy updates as they warn of falling consumer confidence. Next’s first half sales were up 11% and profits rose 14%. But its shares fell 6% due to its more cautious outlook for the second half. Shares in Pets at Home fell 15% as it cut its full year profit forecast after sales fell 5% in its second quarter. Last week, Associated British Foods said sales at Primark will fall around 2% in its second half as concerns about job security weigh on discretionary spending from lower income groups.

UK headline inflation was unchanged at 3.8% in the year to August and the British Retail Consortium said high food and utility costs are affecting confidence as consumers generally expect the economy to deteriorate this year. Next used its update to warn that rising taxes, fewer jobs and new regulation is stifling growth. The disappointing updates and gloomy outlook dragged other UK retailers down this week.

For more information regarding our weekly market reports, we encourage you to give us a call on 01732 746188 or send us an email at enquiries@foxgroveassociates.co.uk.

This document has been prepared for general information only. It does not contain all of the information which an investor may require in order to make an investment decision. If you are unsure whether this is a suitable investment you should speak to your financial adviser. This information is not guaranteed to be correct, complete, or accurate. Financial Express Investments Ltd, registration number 03110696, is authorised and regulated by the Financial Conduct Authority (FRN 209967). For our full disclaimer please visit https://www.fefundinfo.com/en-gb/about/legal-and-policies/.