-

MARKETS COOL ON TECH AND DEFENCE STOCK VALUATIONS

Data Sourced from FE Analytics, and Bloomberg Finance LP

MARKETS COOL ON TECH AND DEFENCE STOCK VALUATIONS

This week was a time for re-evaluating lofty expectations. Tech stocks have been climbing since the April Orange Crash pulling the rest of the market with them. It has been a game of high investor expectations, with performance surpassing predictions from AI related companies as they invest heavily to get ahead. But a report by MIT, questioning the immediate profitability of such investments, and some comments about frothy valuations sent investors scurrying for the exit. Similarly, separate meetings between the US president and parties involved in the Russia-Ukraine war, since last Friday, have elevated hopes for a peace settlement. In turn, European defence shares retreated on speculation that the planned European military build-up, which companies have profited from so far this year, may be scaled back.

Elsewhere, UK inflation accelerated more than expected in July, lowering the prospect of further rate cuts by the Bank of England. Sterling and gilts fell as a result. Now all eyes are on the Federal Reserve’s annual summit on Friday and the Fed chair’s tone on monetary policy.

UK: INFLATION RISES TO 3.8% ON SOARING HOUSING AND SERVICES COSTS

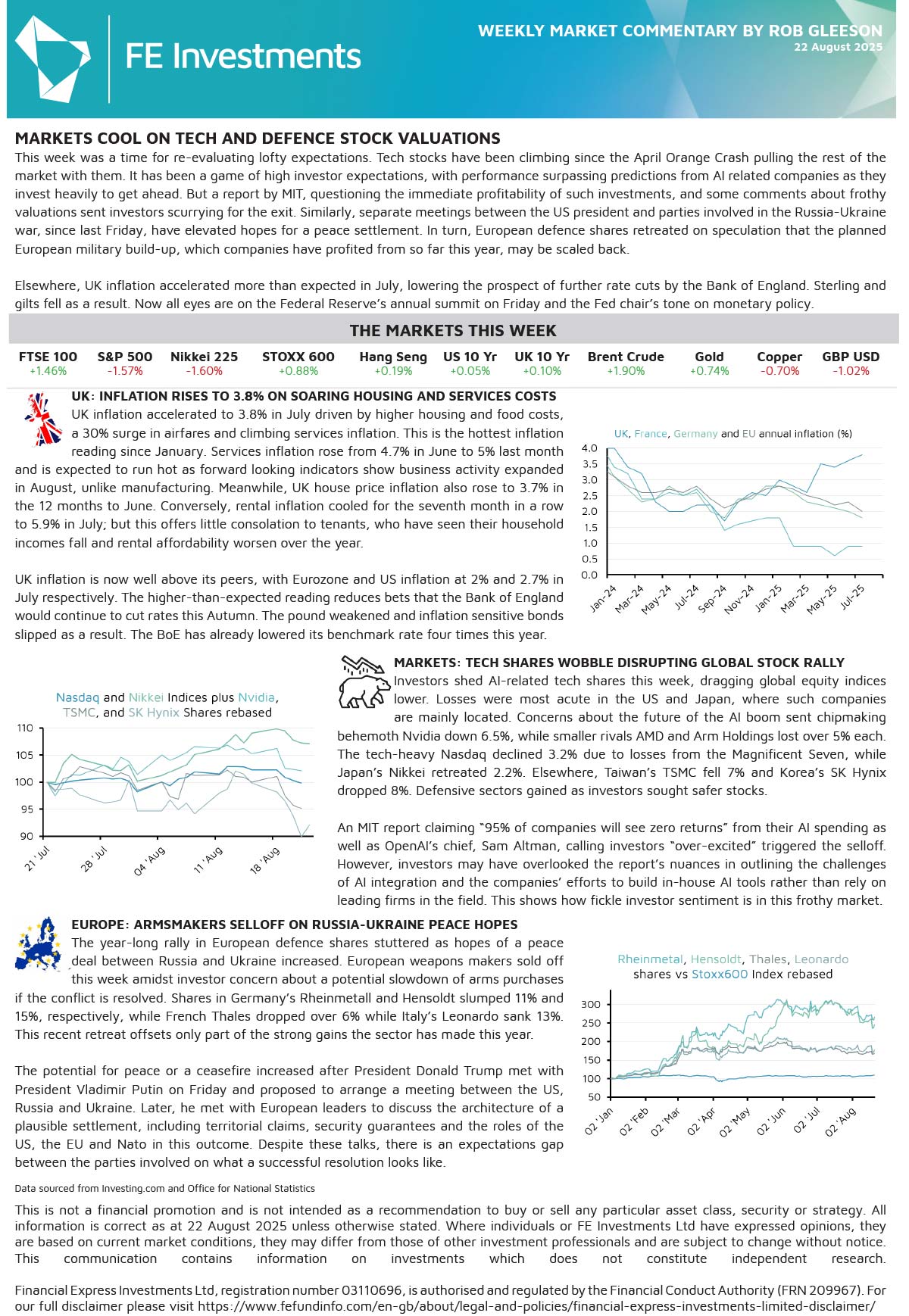

UK inflation accelerated to 3.8% in July driven by higher housing and food costs, a 30% surge in airfares and climbing services inflation. This is the hottest inflation reading since January. Services inflation rose from 4.7% in June to 5% last month and is expected to run hot as forward looking indicators show business activity expanded in August, unlike manufacturing. Meanwhile, UK house price inflation also rose to 3.7% in the 12 months to June. Conversely, rental inflation cooled for the seventh month in a row to 5.9% in July; but this offers little consolation to tenants, who have seen their household incomes fall and rental affordability worsen over the year.

UK inflation is now well above its peers, with Eurozone and US inflation at 2% and 2.7% in July respectively. The higher-than-expected reading reduces bets that the Bank of England would continue to cut rates this Autumn. The pound weakened and inflation sensitive bonds slipped as a result. The BoE has already lowered its benchmark rate four times this year.

MARKETS: TECH SHARES WOBBLE DISRUPTING GLOBAL STOCK RALLY

Investors shed AI-related tech shares this week, dragging global equity indices lower. Losses were most acute in the US and Japan, where such companies are mainly located. Concerns about the future of the AI boom sent chipmaking behemoth Nvidia down 6.5%, while smaller rivals AMD and Arm Holdings lost over 5% each. The tech-heavy Nasdaq declined 3.2% due to losses from the Magnificent Seven, while Japan’s Nikkei retreated 2.2%. Elsewhere, Taiwan’s TSMC fell 7% and Korea’s SK Hynix dropped 8%. Defensive sectors gained as investors sought safer stocks.

An MIT report claiming “95% of companies will see zero returns” from their AI spending as well as OpenAI’s chief, Sam Altman, calling investors “over-excited” triggered the selloff. However, investors may have overlooked the report’s nuances in outlining the challenges of AI integration and the companies’ efforts to build in-house AI tools rather than rely on leading firms in the field. This shows how fickle investor sentiment is in this frothy market.

EUROPE: ARMSMAKERS SELLOFF ON RUSSIA-UKRAINE PEACE HOPES

The year-long rally in European defence shares stuttered as hopes of a peace deal between Russia and Ukraine increased. European weapons makers sold off this week amidst investor concern about a potential slowdown of arms purchases if the conflict is resolved. Shares in Germany’s Rheinmetall and Hensoldt slumped 11% and 15%, respectively, while French Thales dropped over 6% while Italy’s Leonardo sank 13%. This recent retreat offsets only part of the strong gains the sector has made this year.

The potential for peace or a ceasefire increased after President Donald Trump met with President Vladimir Putin on Friday and proposed to arrange a meeting between the US, Russia and Ukraine. Later, he met with European leaders to discuss the architecture of a plausible settlement, including territorial claims, security guarantees and the roles of the US, the EU and Nato in this outcome. Despite these talks, there is an expectations gap between the parties involved on what a successful resolution looks like.

For more information regarding our weekly market reports, we encourage you to give us a call on 01732 746188 or send us an email at enquiries@foxgroveassociates.co.uk.

This document has been prepared for general information only. It does not contain all of the information which an investor may require in order to make an investment decision. If you are unsure whether this is a suitable investment you should speak to your financial adviser. This information is not guaranteed to be correct, complete, or accurate. Financial Express Investments Ltd, registration number 03110696, is authorised and regulated by the Financial Conduct Authority (FRN 209967). For our full disclaimer please visit https://www.fefundinfo.com/en-gb/about/legal-and-policies/.