-

RECIPROCAL TARIFFS COME INTO EFFECT AS EXPORTERS LOOK TO NEW MARKETS

Data Sourced from FE Analytics, and Bloomberg Finance LP

RECIPROCAL TARIFFS COME INTO EFFECT AS EXPORTERS LOOK TO NEW MARKETS

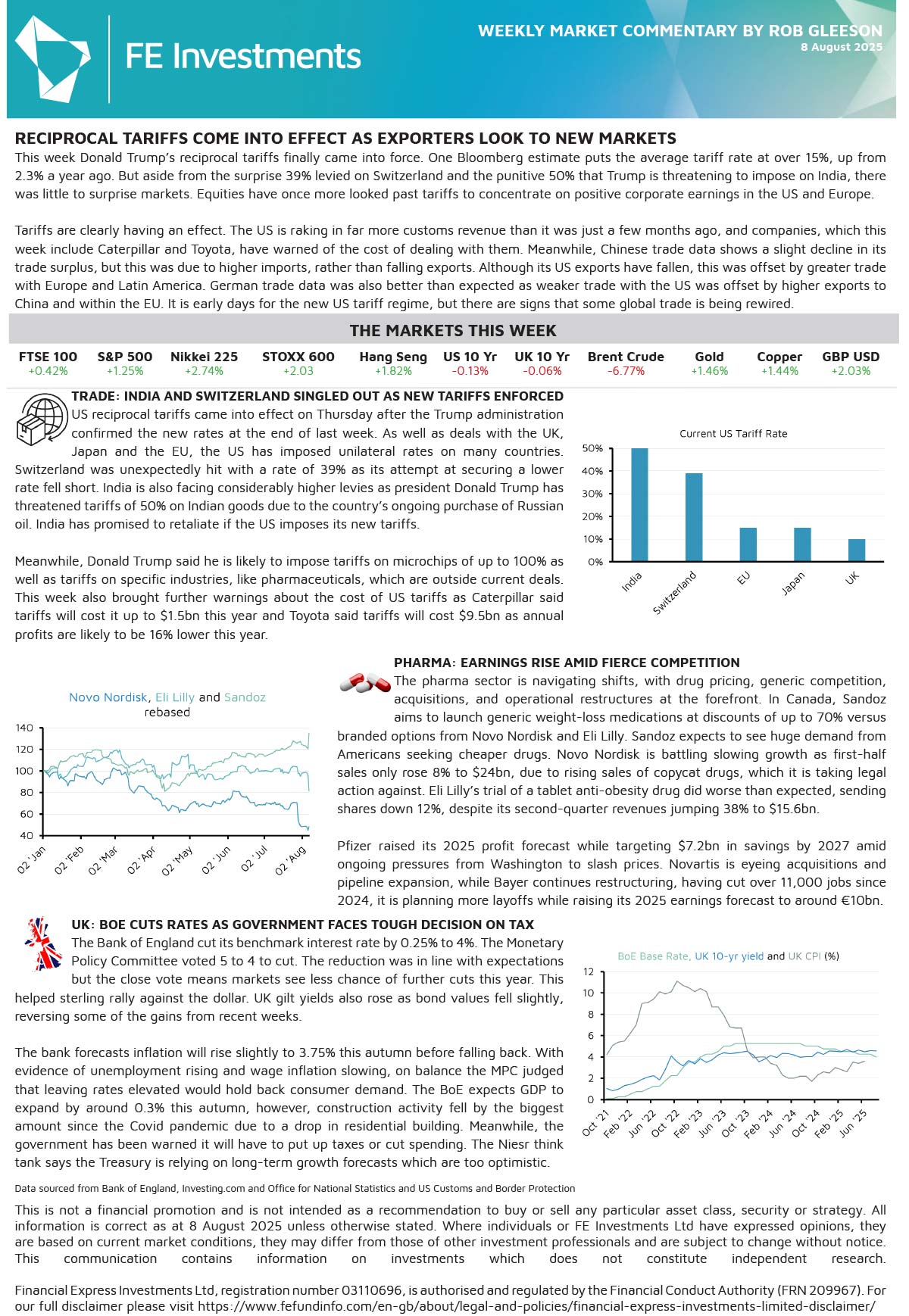

This week Donald Trump’s reciprocal tariffs finally came into force. One Bloomberg estimate puts the average tariff rate at over 15%, up from 2.3% a year ago. But aside from the surprise 39% levied on Switzerland and the punitive 50% that Trump is threatening to impose on India, there was little to surprise markets. Equities have once more looked past tariffs to concentrate on positive corporate earnings in the US and Europe.

Tariffs are clearly having an effect. The US is raking in far more customs revenue than it was just a few months ago, and companies, which this week include Caterpillar and Toyota, have warned of the cost of dealing with them. Meanwhile, Chinese trade data shows a slight decline in its trade surplus, but this was due to higher imports, rather than falling exports. Although its US exports have fallen, this was offset by greater trade with Europe and Latin America. German trade data was also better than expected as weaker trade with the US was offset by higher exports to China and within the EU. It is early days for the new US tariff regime, but there are signs that some global trade is being rewired.

TRADE: INDIA AND SWITZERLAND SINGLED OUT AS NEW TARIFFS ENFORCED

US reciprocal tariffs came into effect on Thursday after the Trump administration confirmed the new rates at the end of last week. As well as deals with the UK, Japan and the EU, the US has imposed unilateral rates on many countries. Switzerland was unexpectedly hit with a rate of 39% as its attempt at securing a lower rate fell short. India is also facing considerably higher levies as president Donald Trump has threatened tariffs of 50% on Indian goods due to the country’s ongoing purchase of Russian oil. India has promised to retaliate if the US imposes its new tariffs.

Meanwhile, Donald Trump said he is likely to impose tariffs on microchips of up to 100% as well as tariffs on specific industries, like pharmaceuticals, which are outside current deals. This week also brought further warnings about the cost of US tariffs as Caterpillar said tariffs will cost it up to $1.5bn this year and Toyota said tariffs will cost $9.5bn as annual profits are likely to be 16% lower this year.

PHARMA: EARNINGS RISE AMID FIERCE COMPETITION

The pharma sector is navigating shifts, with drug pricing, generic competition, acquisitions, and operational restructures at the forefront. In Canada, Sandoz aims to launch generic weight-loss medications at discounts of up to 70% versus branded options from Novo Nordisk and Eli Lilly. Sandoz expects to see huge demand from Americans seeking cheaper drugs. Novo Nordisk is battling slowing growth as first-half sales only rose 8% to $24bn, due to rising sales of copycat drugs, which it is taking legal action against. Eli Lilly’s trial of a tablet anti-obesity drug did worse than expected, sending shares down 12%, despite its second-quarter revenues jumping 38% to $15.6bn.

Pfizer raised its 2025 profit forecast while targeting $7.2bn in savings by 2027 amid ongoing pressures from Washington to slash prices. Novartis is eyeing acquisitions and pipeline expansion, while Bayer continues restructuring, having cut over 11,000 jobs since 2024, it is planning more layoffs while raising its 2025 earnings forecast to around €10bn.

UK: BOE CUTS RATES AS GOVERNMENT FACES TOUGH DECISION ON TAX

The Bank of England cut its benchmark interest rate by 0.25% to 4%. The Monetary Policy Committee voted 5 to 4 to cut. The reduction was in line with expectations but the close vote means markets see less chance of further cuts this year. This helped sterling rally against the dollar. UK gilt yields also rose as bond values fell slightly, reversing some of the gains from recent weeks.

The bank forecasts inflation will rise slightly to 3.75% this autumn before falling back. With evidence of unemployment rising and wage inflation slowing, on balance the MPC judged that leaving rates elevated would hold back consumer demand. The BoE expects GDP to expand by around 0.3% this autumn, however, construction activity fell by the biggest amount since the Covid pandemic due to a drop in residential building. Meanwhile, the government has been warned it will have to put up taxes or cut spending. The Niesr think tank says the Treasury is relying on long-term growth forecasts which are too optimistic.

For more information regarding our weekly market reports, we encourage you to give us a call on 01732 746188 or send us an email at enquiries@foxgroveassociates.co.uk.

This document has been prepared for general information only. It does not contain all of the information which an investor may require in order to make an investment decision. If you are unsure whether this is a suitable investment you should speak to your financial adviser. This information is not guaranteed to be correct, complete, or accurate. Financial Express Investments Ltd, registration number 03110696, is authorised and regulated by the Financial Conduct Authority (FRN 209967). For our full disclaimer please visit https://www.fefundinfo.com/en-gb/about/legal-and-policies/.