-

JAPAN LEADS GLOBAL EQUITIES HIGHER AS OIL RISES SHARPLY

Data Sourced from FE Analytics, and Bloomberg Finance LP

JAPAN LEADS GLOBAL EQUITIES HIGHER AS OIL RISES SHARPLY

This week Japanese equities continued their strong run as Sanae Takaichi became the country’s first female prime minister. As a protégé of former prime minister Shinzo Abe, she is expected to bring more stimulus and contribute to slower interest rate hikes. Markets have welcomed her rise to power as Japanese equities continue their recent outperformance. They were not alone, as other developed markets and Asian equities also made big gains. However, markets have not been drama free. US bank stocks have been volatile due to concerns about the quality of lending by regional banks. Gold and other precious metals sold off as some retail demand disappeared and a mild thaw in China/US relations and strengthening of the dollar combined. The imposition of US sanctions on Russia’s biggest oil companies pushed up the price of oil significantly.

Britain’s mood has been positive as UK gilts joined the equity rally. Better consumer inflation raised hopes of more aggressive rate cuts from the Bank of England. Retail spending picked up, consumer confidence is rising (from a low level) and services and manufacturing output accelerated.

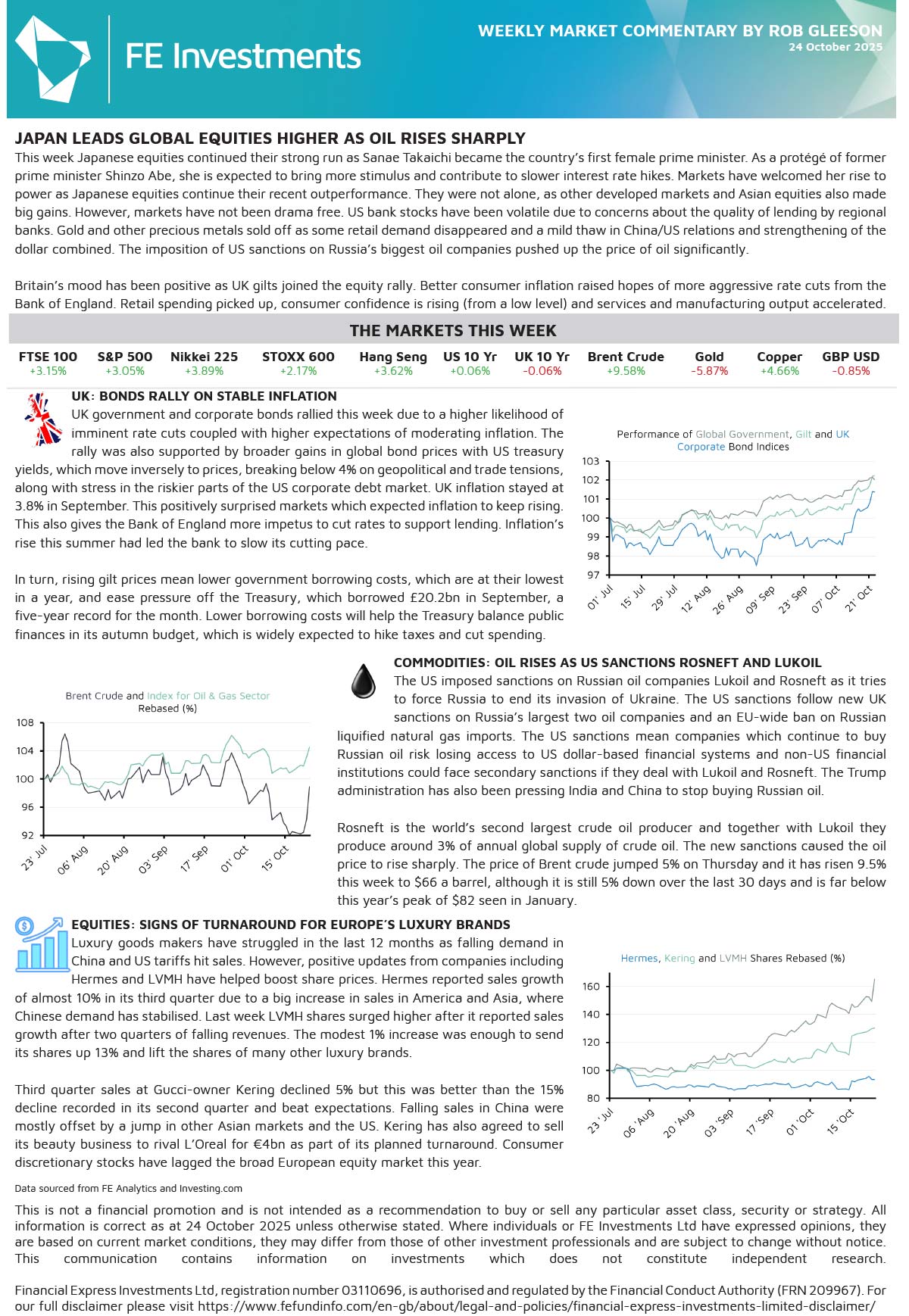

UK: BONDS RALLY ON STABLE INFLATION

UK government and corporate bonds rallied this week due to a higher likelihood of imminent rate cuts coupled with higher expectations of moderating inflation. The rally was also supported by broader gains in global bond prices with US treasury yields, which move inversely to prices, breaking below 4% on geopolitical and trade tensions, along with stress in the riskier parts of the US corporate debt market. UK inflation stayed at 3.8% in September. This positively surprised markets which expected inflation to keep rising. This also gives the Bank of England more impetus to cut rates to support lending. Inflation’s rise this summer had led the bank to slow its cutting pace.

In turn, rising gilt prices mean lower government borrowing costs, which are at their lowest in a year, and ease pressure off the Treasury, which borrowed £20.2bn in September, a five-year record for the month. Lower borrowing costs will help the Treasury balance public finances in its autumn budget, which is widely expected to hike taxes and cut spending.

COMMODITIES: OIL RISES AS US SANCTIONS ROSNEFT AND LUKOIL

The US imposed sanctions on Russian oil companies Lukoil and Rosneft as it tries to force Russia to end its invasion of Ukraine. The US sanctions follow new UK sanctions on Russia’s largest two oil companies and an EU-wide ban on Russian liquified natural gas imports. The US sanctions mean companies which continue to buy Russian oil risk losing access to US dollar-based financial systems and non-US financial institutions could face secondary sanctions if they deal with Lukoil and Rosneft. The Trump administration has also been pressing India and China to stop buying Russian oil.

Rosneft is the world’s second largest crude oil producer and together with Lukoil they produce around 3% of annual global supply of crude oil. The new sanctions caused the oil price to rise sharply. The price of Brent crude jumped 5% on Thursday and it has risen 9.5% this week to $66 a barrel, although it is still 5% down over the last 30 days and is far below this year’s peak of $82 seen in January.

EQUITIES: SIGNS OF TURNAROUND FOR EUROPE’S LUXURY BRANDS

Luxury goods makers have struggled in the last 12 months as falling demand in China and US tariffs hit sales. However, positive updates from companies including Hermes and LVMH have helped boost share prices. Hermes reported sales growth of almost 10% in its third quarter due to a big increase in sales in America and Asia, where Chinese demand has stabilised. Last week LVMH shares surged higher after it reported sales growth after two quarters of falling revenues. The modest 1% increase was enough to send its shares up 13% and lift the shares of many other luxury brands.

Third quarter sales at Gucci-owner Kering declined 5% but this was better than the 15% decline recorded in its second quarter and beat expectations. Falling sales in China were mostly offset by a jump in other Asian markets and the US. Kering has also agreed to sell its beauty business to rival L’Oreal for €4bn as part of its planned turnaround. Consumer discretionary stocks have lagged the broad European equity market this year.

For more information regarding our weekly market reports, we encourage you to give us a call on 01732 746188 or send us an email at enquiries@foxgroveassociates.co.uk.

This document has been prepared for general information only. It does not contain all of the information which an investor may require in order to make an investment decision. If you are unsure whether this is a suitable investment you should speak to your financial adviser. This information is not guaranteed to be correct, complete, or accurate. Financial Express Investments Ltd, registration number 03110696, is authorised and regulated by the Financial Conduct Authority (FRN 209967). For our full disclaimer please visit https://www.fefundinfo.com/en-gb/about/legal-and-policies/.