-

DECEMBER HIKE IN JAPAN APPEARS BAKED IN AS MARKETS ARE NERVOUS OF FURTHER TIGHTENING

Data Sourced from FE Analytics, and Bloomberg Finance LP

DECEMBER HIKE IN JAPAN APPEARS BAKED IN AS MARKETS ARE NERVOUS OF FURTHER TIGHTENING

This week the more aggressive tone from the Bank of Japan sent ripples through global government bond markets as the central bank and the new prime minister appear to have different views on the appropriate direction for interest rates. The size of the yen “carry trade” – using cheap borrowing in Japanese yen to fund investments in other currencies – is difficult to estimate but widely considered significant. The yield on Japa- nese government bonds increased considerably on Monday and the yield on 10-year bonds is at its highest since 2007. The yields on US and European government bonds have followed Japan higher.

Previous periods of yen strength have triggered or coincided with declining equity markets. Japanese stocks fell at the start of the week as a stronger yen affected some large exporters, however, the broad market recovered over the course of the week. Markets now see one or two additional rate hikes in 2026 following a widely expected hike this month and more aggressive rate hikes are something to be aware of.

GLOBAL: GOVERNMENT BONDS UNDER PRESSURE AS BOJ EXPECTED TO HIKE

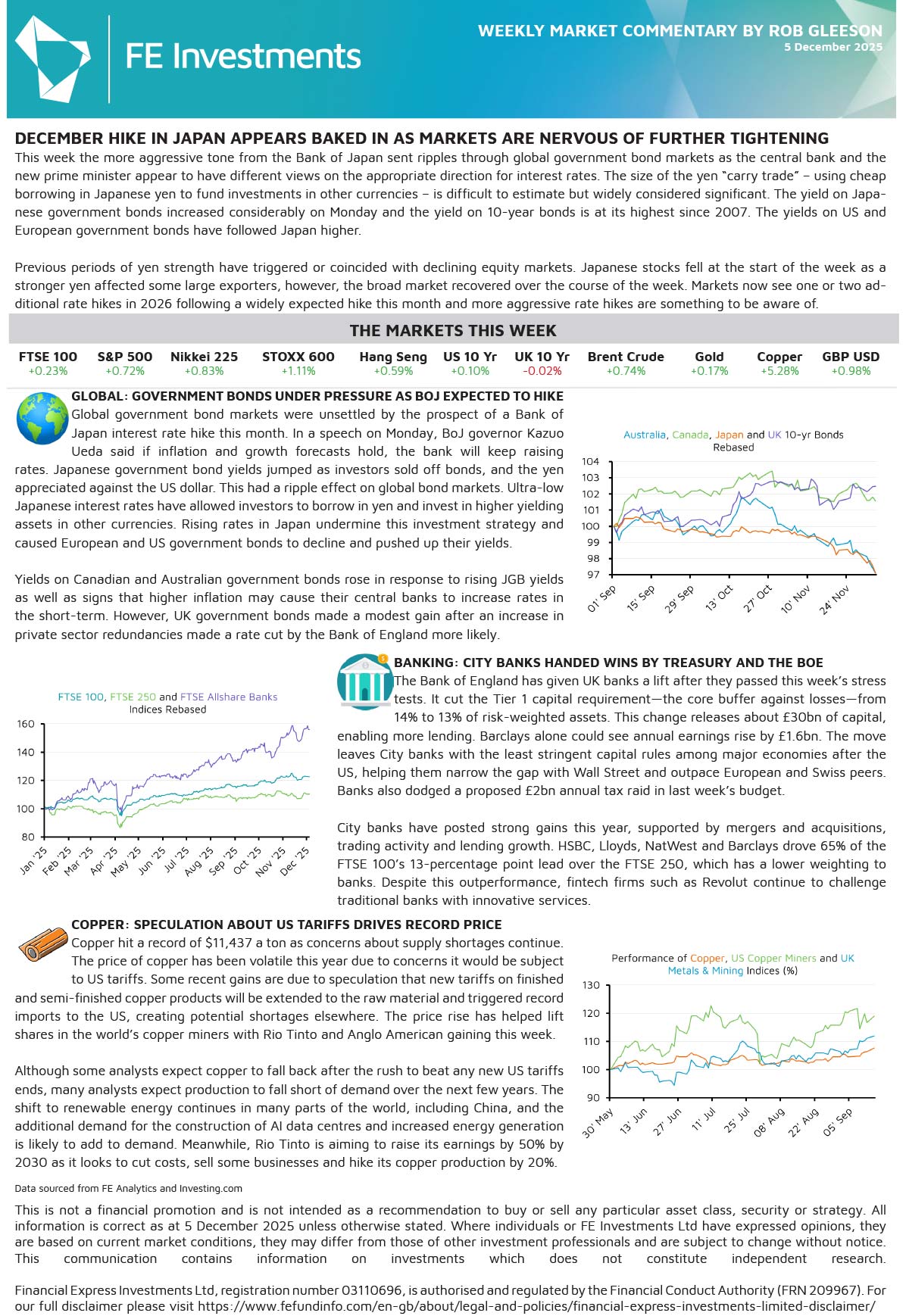

Global government bond markets were unsettled by the prospect of a Bank of Japan interest rate hike this month. In a speech on Monday, BoJ governor Kazuo Ueda said if inflation and growth forecasts hold, the bank will keep raising rates. Japanese government bond yields jumped as investors sold off bonds, and the yen appreciated against the US dollar. This had a ripple effect on global bond markets. Ultra-low Japanese interest rates have allowed investors to borrow in yen and invest in higher yielding assets in other currencies. Rising rates in Japan undermine this investment strategy and caused European and US government bonds to decline and pushed up their yields.

Yields on Canadian and Australian government bonds rose in response to rising JGB yields as well as signs that higher inflation may cause their central banks to increase rates in the short-term. However, UK government bonds made a modest gain after an increase in private sector redundancies made a rate cut by the Bank of England more likely.

BANKING: CITY BANKS HANDED WINS BY TREASURY AND THE BOE

The Bank of England has given UK banks a lift after they passed this week’s stress tests. It cut the Tier 1 capital requirement—the core buffer against losses—from 14% to 13% of risk-weighted assets. This change releases about £30bn of capital, enabling more lending. Barclays alone could see annual earnings rise by £1.6bn. The move leaves City banks with the least stringent capital rules among major economies after the US, helping them narrow the gap with Wall Street and outpace European and Swiss peers. Banks also dodged a proposed £2bn annual tax raid in last week’s budget.

City banks have posted strong gains this year, supported by mergers and acquisitions, trading activity and lending growth. HSBC, Lloyds, NatWest and Barclays drove 65% of the FTSE 100’s 13-percentage point lead over the FTSE 250, which has a lower weighting to banks. Despite this outperformance, fintech firms such as Revolut continue to challenge traditional banks with innovative services.

COPPER: SPECULATION ABOUT US TARIFFS DRIVES RECORD PRICE

Copper hit a record of $11,437 a ton as concerns about supply shortages continue. The price of copper has been volatile this year due to concerns it would be subject to US tariffs. Some recent gains are due to speculation that new tariffs on finished and semi-finished copper products will be extended to the raw material and triggered record imports to the US, creating potential shortages elsewhere. The price rise has helped lift shares in the world’s copper miners with Rio Tinto and Anglo American gaining this week.

Although some analysts expect copper to fall back after the rush to beat any new US tariffs ends, many analysts expect production to fall short of demand over the next few years. The shift to renewable energy continues in many parts of the world, including China, and the additional demand for the construction of AI data centres and increased energy generation is likely to add to demand. Meanwhile, Rio Tinto is aiming to raise its earnings by 50% by 2030 as it looks to cut costs, sell some businesses and hike its copper production by 20%.

For more information regarding our weekly market reports, we encourage you to give us a call on 01732 746188 or send us an email at enquiries@foxgroveassociates.co.uk.

This document has been prepared for general information only. It does not contain all of the information which an investor may require in order to make an investment decision. If you are unsure whether this is a suitable investment you should speak to your financial adviser. This information is not guaranteed to be correct, complete, or accurate. Financial Express Investments Ltd, registration number 03110696, is authorised and regulated by the Financial Conduct Authority (FRN 209967). For our full disclaimer please visit https://www.fefundinfo.com/en-gb/about/legal-and-policies/.