-

BOND MARKETS APPEAR CONTENT WITH THE CHANCELLOR’S SHORT-TERM BALANCING ACT

Data Sourced from FE Analytics, and Bloomberg Finance LP

BOND MARKETS APPEAR CONTENT WITH THE CHANCELLOR’S SHORT-TERM BALANCING ACT

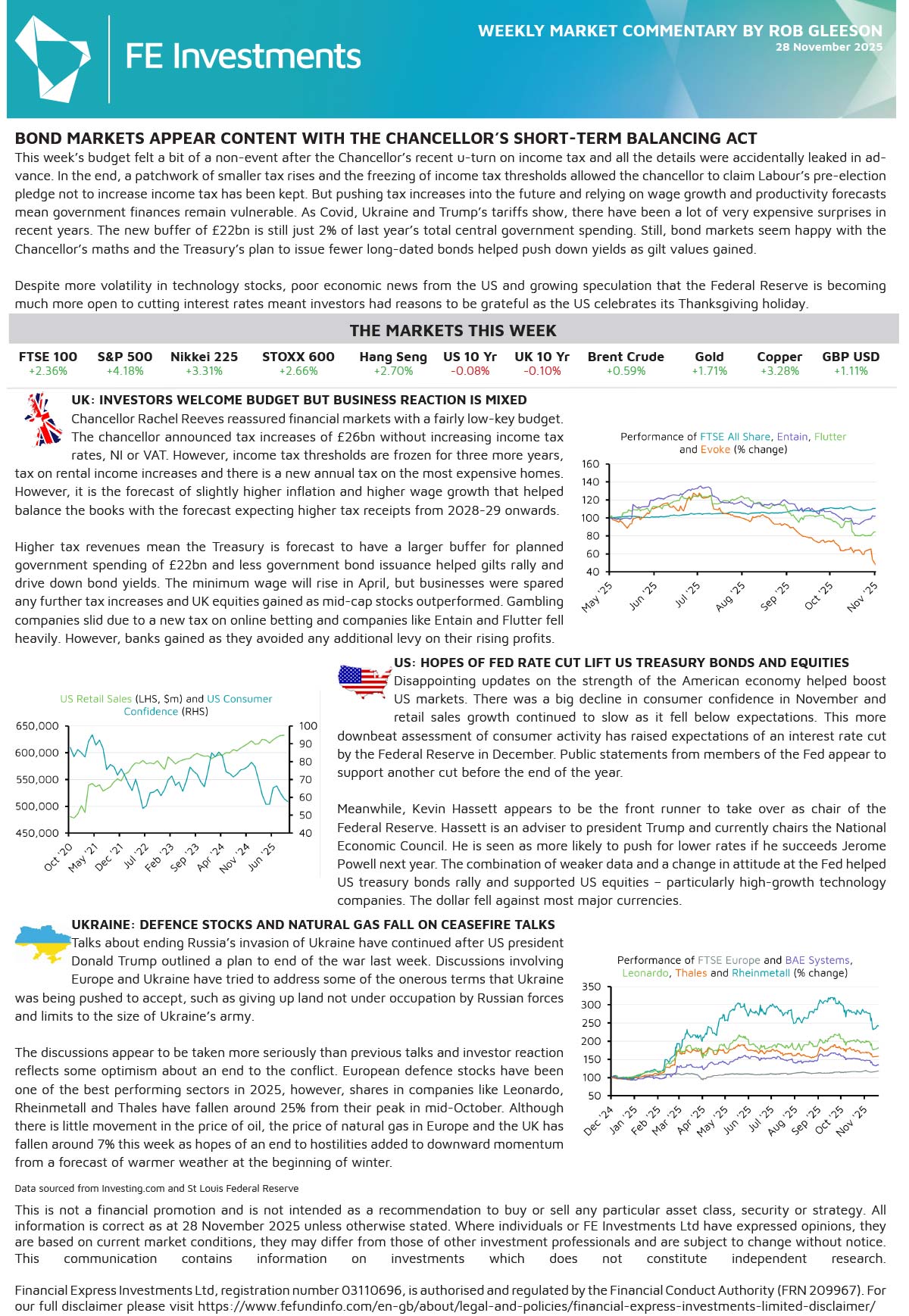

This week’s budget felt a bit of a non-event after the Chancellor’s recent u-turn on income tax and all the details were accidentally leaked in advance. In the end, a patchwork of smaller tax rises and the freezing of income tax thresholds allowed the chancellor to claim Labour’s pre-election pledge not to increase income tax has been kept. But pushing tax increases into the future and relying on wage growth and productivity forecasts mean government finances remain vulnerable. As Covid, Ukraine and Trump’s tariffs show, there have been a lot of very expensive surprises in recent years. The new buffer of £22bn is still just 2% of last year’s total central government spending. Still, bond markets seem happy with the Chancellor’s maths and the Treasury’s plan to issue fewer long-dated bonds helped push down yields as gilt values gained.

Despite more volatility in technology stocks, poor economic news from the US and growing speculation that the Federal Reserve is becoming much more open to cutting interest rates meant investors had reasons to be grateful as the US celebrates its Thanksgiving holiday.

UK: INVESTORS WELCOME BUDGET BUT BUSINESS REACTION IS MIXED

Chancellor Rachel Reeves reassured financial markets with a fairly low-key budget. The chancellor announced tax increases of £26bn without increasing income tax rates, NI or VAT. However, income tax thresholds are frozen for three more years, tax on rental income increases and there is a new annual tax on the most expensive homes. However, it is the forecast of slightly higher inflation and higher wage growth that helped balance the books with the forecast expecting higher tax receipts from 2028-29 onwards.

Higher tax revenues mean the Treasury is forecast to have a larger buffer for planned government spending of £22bn and less government bond issuance helped gilts rally and drive down bond yields. The minimum wage will rise in April, but businesses were spared any further tax increases and UK equities gained as mid-cap stocks outperformed. Gambling companies slid due to a new tax on online betting and companies like Entain and Flutter fell heavily. However, banks gained as they avoided any additional levy on their rising profits.

US: HOPES OF FED RATE CUT LIFT US TREASURY BONDS AND EQUITIES

Disappointing updates on the strength of the American economy helped boost US markets. There was a big decline in consumer confidence in November and retail sales growth continued to slow as it fell below expectations. This more downbeat assessment of consumer activity has raised expectations of an interest rate cut by the Federal Reserve in December. Public statements from members of the Fed appear to support another cut before the end of the year.

Meanwhile, Kevin Hassett appears to be the front runner to take over as chair of the Federal Reserve. Hassett is an adviser to president Trump and currently chairs the National Economic Council. He is seen as more likely to push for lower rates if he succeeds Jerome Powell next year. The combination of weaker data and a change in attitude at the Fed helped US treasury bonds rally and supported US equities – particularly high-growth technology companies. The dollar fell against most major currencies.

UKRAINE: DEFENCE STOCKS AND NATURAL GAS FALL ON CEASEFIRE TALKS

Talks about ending Russia’s invasion of Ukraine have continued after US president Donald Trump outlined a plan to end of the war last week. Discussions involving Europe and Ukraine have tried to address some of the onerous terms that Ukraine was being pushed to accept, such as giving up land not under occupation by Russian forces and limits to the size of Ukraine’s army.

The discussions appear to be taken more seriously than previous talks and investor reaction reflects some optimism about an end to the conflict. European defence stocks have been one of the best performing sectors in 2025, however, shares in companies like Leonardo, Rheinmetall and Thales have fallen around 25% from their peak in mid-October. Although there is little movement in the price of oil, the price of natural gas in Europe and the UK has fallen around 7% this week as hopes of an end to hostilities added to downward momentum from a forecast of warmer weather at the beginning of winter.

For more information regarding our weekly market reports, we encourage you to give us a call on 01732 746188 or send us an email at enquiries@foxgroveassociates.co.uk.

This document has been prepared for general information only. It does not contain all of the information which an investor may require in order to make an investment decision. If you are unsure whether this is a suitable investment you should speak to your financial adviser. This information is not guaranteed to be correct, complete, or accurate. Financial Express Investments Ltd, registration number 03110696, is authorised and regulated by the Financial Conduct Authority (FRN 209967). For our full disclaimer please visit https://www.fefundinfo.com/en-gb/about/legal-and-policies/.